Plant Protein Market Overview 2024:

The plant protein market was USD 18 billion in 2023 and is expected to register a robust revenue CAGR of 14.5% during the forecast period. This growth can be attributed to factors such as growing incidence of intolerance for animal proteins, changing health and wellness trends, and rising adoption of vegan diets and products.

Plant proteins are derived from various plant-based sources such as grains, legumes, nuts, seeds, and certain vegetables. These proteins are rapidly gaining traction across the globe due to rising vegan population and growing demand for vegan and vegetarian products.

Plant proteins are rich in dietary fiber, vitamins, minerals, and phytonutrients and offer numerous health benefits such as lower saturated fats and cholesterol as compared to animal proteins. Moreover, these products are free from common allergens like dairy, eggs, and gluten and serve as better alternatives for individuals with food allergies and intolerances.

Plant-based proteins come in a diverse range of flavors and textures, offering opportunities for culinary creativity and explorations.

However, these products are more expensive as compared to animal-based counterparts. This can limit the adoption of plant protein products in low-income segments.

Graphical Overview:

Key Takeaways:

Rising Demand for Vegan and Vegetarian Products:

The rapidly growing vegan population in many parts of the globe has resulted in increasing demand for different types of vegan and vegetarian products, including plant-based protein alternatives. This is expected to boost global market growth during the forecast period.

Issues Related to Texture and Taste and Insufficient Infrastructure:

Some plant-based proteins face challenges in replicating the taste and texture of animal-based products. So many consumers are reluctant to buy these products. This can hamper the overall market growth to a certain extent during the forecast period. In addition, many economies do not have sufficient funds to deploy the required infrastructure. This can also restrain market growth going ahead.

Market Opportunities:

The plant protein market presents several opportunities to existing and emerging market players due to changing consumer preferences, growing health and environmental concerns, and regulatory support. Companies in the market can focus on diversifying plant protein sources and expanding more plant-based meat alternatives.

Product Type Outlook:

Based on product type, the global market is segmented into soy protein, wheat protein, pea protein, and others. Among these, the soy protein segment is expected to account for a significantly larger revenue share during the forecast period. This growth can be attributed to easy accessibility to soy protein, high usage of soy protein extract across various sectors such as food and beverages, animal feed, personal care products, and industrial applications, and ongoing research on exploring more applications of soy protein.

Application Outlook:

The global market is segmented into supplements & nutritional powders, beverages, protein & nutritional bars, bakery & snacks, breakfast cereals, meat products, dairy products, infant nutrition, animal feed, and others based on applications. Among these, the supplements and nutritional powders segment is expected to register rapid revenue CAGR over the forecast period. Factors such as rising health-conscious population, growing preference for plant-based health supplements and nutritional powders due to health, environmental, or dietary reasons, and rising investments in R&D activities are expected to drive segment revenue between 2024 and 2032.

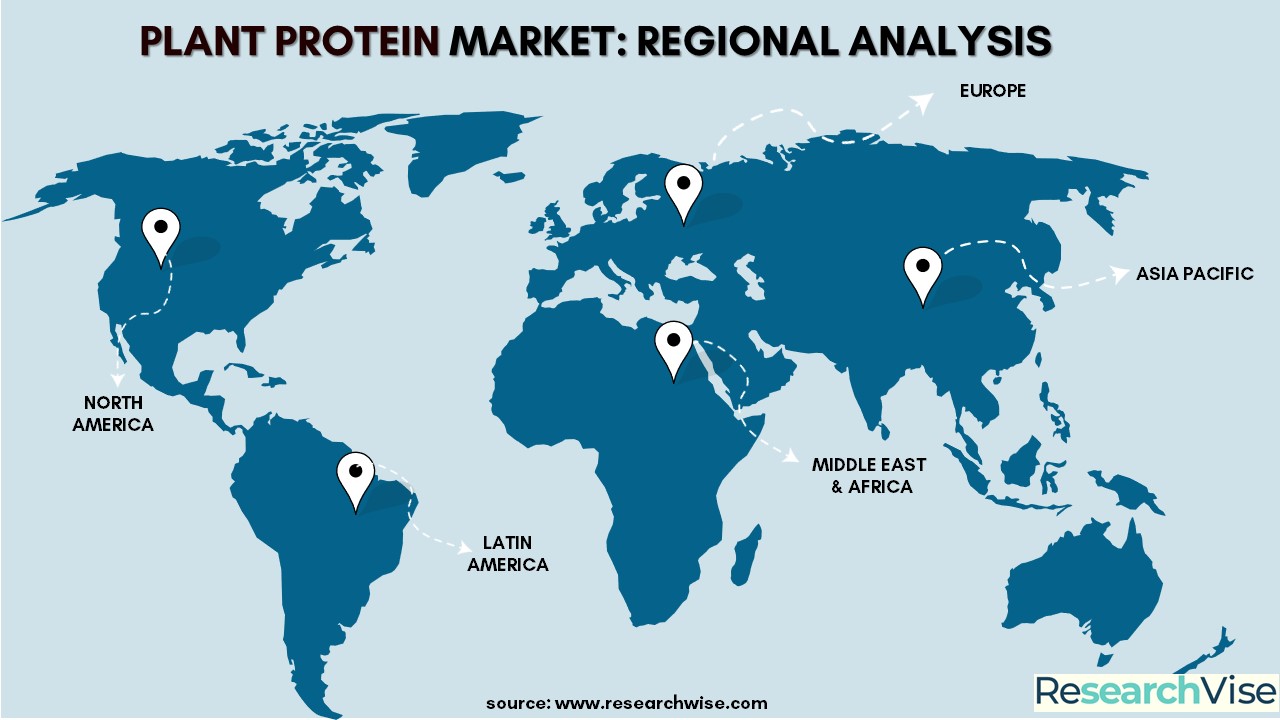

Regional Outlook:

North America is expected to account for the largest revenue share in the global market between 2024 and 2032 owing to growing consumer awareness about the benefits of plant-based diets, rising prevalence of chronic diseases, and rising preference for plant-based food due to animal welfare issues. Other factors such as presence of leading food manufacturing companies, rising investments in developing novel products, and ongoing innovations in food technology are expected to drive North America market growth during the forecast period.

Report Coverage:

| Report Details |

Outcome |

| Base Year for Estimation |

2023 |

| Historical Data |

2018-2022 |

| Forecast Period |

2024-2032 |

| Segments Covered: |

Product Type, Form, Application, and, Region |

| By Product Type |

Soy Protein, Wheat Protein, Pea Protein, Others |

| By Form |

Isolate, Concentrate, Others |

| By Application |

Supplements & Nutritional Powders, Beverages, Protein & Nutritional Bars, Bakery & Snacks, Breakfast Cereals, Meat Products, Dairy Products, Infant Nutrition, Animal Feed, Others |

| Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Country Scope |

United States, Canada, Germany, France, UK, Italy, Russia, China, Japan, South Korea, Southeast Asia, India, Mexico, Brazil, Saudi Arabia, UAE, Turkey |

| Qualitative Info |

•Value Chain Analysis

•Pricing Analysis

•Regional Outlook

•Market Trends

•Market Share Analysis

•Competition Analysis

•Technological Advancements |

| Key Players |

AGT Food & Ingredients, Inc., Batory Foods, Ag Processing Inc., Archer-Daniels Midland Co., Biopress S.A.S, Burcon Nutrascience Corporation, Cargill Inc., CHS Inc., Cosucra Groupe Warcoing, Crown Soya Protein Group, Devansoy Inc., Fuji Oil Holdings Inc., Glanbia PLC, Gushen Group Co. Ltd., Ingredion Inc., Shandong Yuwang Ecological Food Industry Co., Ltd., The Scoular Company |

| Customization Scope |

10 Hours of Free Customization and Expert Consultation |

Competitive Landscape:

The global plant protein market is extremely competitive, comprising key regional and global players. Leading key players are focused on adopting various strategic alliances like mergers and acquisitions, partnerships, joint ventures, collaborations, and product launches to maintain their global position and enhance their product offerings. They are also focused on innovation, and scalability, adapting to evolving technology trends and consumer needs.

Some Leading Market Companies Listed in the Report:

- AGT Food & Ingredients, Inc.

- Batory Foods

- Ag Processing Inc.

- Archer-Daniels Midland Co.

- Biopress S.A.S

- Burcon Nutrascience Corporation

- Cargill Inc.

- CHS Inc.

- Cosucra Groupe Warcoing

- Crown Soya Protein Group

- Devansoy Inc.

- Fuji Oil Holdings Inc.

- Glanbia PLC

- Gushen Group Co. Ltd.

- Ingredion Inc.

- Shandong Yuwang Ecological Food Industry Co., Ltd.

- The Scoular Company

Plant Protein Industry Recent Developments:

- In November 2023, FMCG major Nestle India announced the launch of plant-based protein products.

- In June 2022, Roquette announced the expansion of its NUTRALYS rice protein range with the launch of two rice proteins.

The global plant protein market has been segmented based on product type, form, application and region:

By Product Type:

- Soy Protein

- Wheat Protein

- Pea Protein

- Others

By Form:

- Isolate

- Concentrate

- Others

By Application:

- Supplements & Nutritional Powders

- Beverages

- Protein & Nutritional Bars

- Bakery & Snacks

- Breakfast Cereals

- Meat Products

- Dairy Products

- Infant Nutrition

- Animal Feed

- Others

By Region:

- North America

- Europe

- Germany

- France

- UK

- Italy

- Russia

- Nordic Countries

- Asia Pacific

- China

- Japan

- South Korea

- Southeast Asia

- India

- Australia

- Rest of Asia

- Latin America

- Mexico

- Brazil

- Rest of Latin America

- Middle East & Africa

- Turkey

- Saudi Arabia

- UAE

- Rest of MEA

Frequently Asked Questions!

The Plant Protein Market is segmented based on Type, Application, and by region.

- AGT Food & Ingredients, Inc.

- Batory Foods

- Ag Processing Inc.

- Archer-Daniels Midland Co.

- Biopress S.A.S

- Burcon Nutrascience Corporation

- Cargill Inc.

- CHS Inc.

- Cosucra Groupe Warcoing

- Crown Soya Protein Group

- Devansoy Inc.

- Fuji Oil Holdings Inc.

- Glanbia PLC

- Gushen Group Co. Ltd.

- Ingredion Inc.

- Shandong Yuwang Ecological Food Industry Co., Ltd.

- The Scoular Company

are the top players in the market.

The Plant Protein Market report provides global companies with an opportunity to enter new markets, invest in new sectors, analyze consumer reactions, investigate global competition, and ultimately make smart investments.

Factors such as competitive strength and market positioning are key areas considered while selecting top companies to be profiled.

Chapter 1. Methodology and Scope

1.1. Methodology Segmentation & Scope

1.2. Information Procurement

1.2.1. Purchased database

1.2.2. Secondary Sources

1.2.3. Third-party Perspectives

1.2.4. Primary research

1.3. Information Analysis

1.3.1. Data Analysis Models

1.4. Market Formulation & Data Visualization

1.5. Research Scope & Assumptions

Chapter 2. Executive Summary

2.1. Plant Protein Market- Industry Snapshot, 2018 - 2032

Chapter 3. Plant Protein Market Variables, Trends & Scope

3.1. Market Size and Growth Prospects, 2024-2032

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint/Challenge Analysis

3.3.3. Market Opportunity Analysis

3.4. Penetration & Growth Prospect Mapping

3.5. Business Environment Analysis Tools

3.5.1. Industry Analysis - Porter's Five Forces Analysis

3.5.2. PEST Analysis

3.5.3. COVID-19 Impact Analysis

Chapter 4. Plant Protein Market Type Outlook 2024-2032 (USD Million)

Chapter 5. Plant Protein Market Application Outlook 2024-2032(USD Million)

Chapter 6: Coronavirus Diseases (COVID-19) Impact:

6.1. Introduction

6.2 Current and Future Impact Analysis

6.3 Economic Impact Analysis

6.4 Investment Scenario

Chapter 7. North America Plant Protein Market Share by Region, 2024 & 2032 (USD Million)

7.1. Market Estimates and Forecast 2024 - 2032 (USD Million)

7.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

7.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

7.4.1. U.S.

7.4.1.1. Market Estimates and Forecast 2024-2032 (USD Million)

7.4.1.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

7.4.1.3 Market Estimates and Forecast by Application, 2024-2032 (USD Million)

7. 4.2. Canada

7. 4.2.1. Market Estimates and Forecast 2024-2032 (USD Million)

7. 4.2.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

7. 4.2.3 Market Estimates and Forecast by Application, 2024-2032 (USD Million)

Chapter 8. Europe Plant Protein Market Share by Region, 2024 & 2032 (USD Million)

8.1. Market Estimates and Forecast 2024 - 2032 (USD Million)

8.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

8.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

8.4.1. Germany

8.4.1.1. Market Estimates and Forecast 2024-2032 (USD Million)

8.4.1.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

8.4.1.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

8.4.2. France

8.4.2.1. Market Estimates and Forecast 2024-2032 (USD Million)

8.4.2.3. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

8.4.2.3. Market Estimates and Forecast by Application 2024-2032 (USD Million)

8.4.3. UK

8.4.3.1. Market Estimates and Forecast 2024-2032 (USD Million)

8.4.3.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

8.2.3.3. Market Estimates and Forecast by Application 2024-2032 (USD Million)

8.4.4. Italy

8.4.4.1. Market Estimates and Forecast 2024-2032 (USD Million)

8.4.4.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

8.4.4.3. Market Estimates and Forecast by Application 2024-2032 (USD Million)

8.4.5. Russia

8.4.5.1. Market Estimates and Forecast 2024-2032 (USD Million)

8.4.5.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

8.4.5.3. Market Estimates and Forecast by Application 2024-2032 (USD Million)

8.4.6. Nordic Countries

8.4.6.1. Market Estimates and Forecast 2024-2032 (USD Million)

8.4.6.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

8.4.6.3. Market Estimates and Forecast by Application 2024-2032 (USD Million)

8.4.7. Rest of Europe

8.4.7.1. Market Estimates and Forecast 2024-2032 (USD Million)

8.4.7.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

8.4.7.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

Chapter 9. Asia Pacific Plant Protein Market Share by Region, 2024 & 2032 (USD Million)

9.1. Market Estimates and Forecast 2024 - 2032 (USD Million)

9.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

9.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

9.4.1. China

9.4.1.1. Market Estimates and Forecast 2024-2032 (USD Million)

9.4.1.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

9.4.1.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

9.4.2. Japan

9.4.2.1. Market Estimates and Forecast 2024-2032 (USD Million)

9.4.2.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

9.4.2.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

9.4.3. South Korea

9.4.3.1. Market Estimates and Forecast 2024-2032 (USD Million)

9.4.3.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

9.4.3.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

9.4.4. India

9.4.4.1. Market Estimates and Forecast 2024-2032 (USD Million)

9.4.4.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

9.4.4.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

9.4.5. Australia

9.4.5.1. Market Estimates and Forecast 2024-2032 (USD Million)

9.4.5.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

9.4.5.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

9.4.6. Rest of Asia Pacific

9.4.6.1. Market Estimates and Forecast 2024-2032 (USD Million)

9.4.6.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

9.4.6.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

Chapter 10. Latin America Plant Protein Market Share by Region, 2024 & 2032 (USD Million)

10.1. Market Estimates and Forecast 2024 - 2032 (USD Million)

10.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

10.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

10.4.1. Mexico

10.4.1.1. Market Estimates and Forecast 2024-2032 (USD Million)

10.4.1.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

10.4.1.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

10.4.2. Brazil

10.4.2.1. Market Estimates and Forecast 2024-2032 (USD Million)

10.4.2.2 Market Estimates and Forecast by Type, 2024-2032 (USD Million)

10.4.2.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

10.4.3 Rest of Latin America

10.4.3.1 Market Estimates and Forecast 2024-2032 (USD Million)

10.4.3.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

10.4.3.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

Chapter 11. Middle East and Africa Plant Protein Market Share by Region, 2024 & 2032 (USD Million)

11.1. Market Estimates and Forecast 2024 - 2032 (USD Million)

11.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

11.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million

11.4.1 Turkey

11.4.1.1 Market Estimates and Forecast 2024-2032 (USD Million)

11.4.4.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

11.4.4.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

11.4.2. Saudi Arabia

11.4.2.1. Market Estimates and Forecast 2024-2032 (USD Million)

11.4.2.2 Market Estimates and Forecast by Type, 2024-2032 (USD Million)

11.4.2.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

11.4.3 UAE

11.4.3.1. Market Estimates and Forecast 2024-2032 (USD Million)

11.4.3.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

11.4.4.1. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

11.4.5. Rest of MEA

11.4.5.1. Market Estimates and Forecast 2024-2032 (USD Million)

11.4.5.2. Market Estimates and Forecast by Type, 2024-2032 (USD Million)

11.4.5.3. Market Estimates and Forecast by Application, 2024-2032 (USD Million)

Chapter 12 Plant Protein Market Competitive Landscape

- AGT Food & Ingredients, Inc.

- Batory Foods

- Ag Processing Inc.

- Archer-Daniels Midland Co.

- Biopress S.A.S

- Burcon Nutrascience Corporation

- Cargill Inc.

- CHS Inc.

- Cosucra Groupe Warcoing

- Crown Soya Protein Group

- Devansoy Inc.

- Fuji Oil Holdings Inc.

- Glanbia PLC

- Gushen Group Co. Ltd.

- Ingredion Inc.

- Shandong Yuwang Ecological Food Industry Co., Ltd.

- The Scoular Company

- AGT Food & Ingredients, Inc.

- Batory Foods

- Ag Processing Inc.

- Archer-Daniels Midland Co.

- Biopress S.A.S

- Burcon Nutrascience Corporation

- Cargill Inc.

- CHS Inc.

- Cosucra Groupe Warcoing

- Crown Soya Protein Group

- Devansoy Inc.

- Fuji Oil Holdings Inc.

- Glanbia PLC

- Gushen Group Co. Ltd.

- Ingredion Inc.

- Shandong Yuwang Ecological Food Industry Co., Ltd.

- The Scoular Company